As the commercial real estate (CRE) landscape in Phoenix continues to evolve, investors and owner-users alike are navigating an environment defined by economic change, policy updates, and shifting market sentiment. While uncertainty remains around tariffs and tax reform, one theme has become increasingly clear: the Phoenix CRE market is not retreating—it’s recalibrating.

Stability Amid Change: Phoenix’s CRE Market Fundamentals

Despite broader concerns, Phoenix’s commercial real estate market remains fundamentally sound. In Q1 2025, national CRE investment volume hit $92.5 billion—up 17% year-over-year—even though total transaction counts dropped by 12%. This suggests capital is still active, but being deployed more strategically.

Although the Commercial Real Estate Finance Council’s Sentiment Index saw a notable dip this quarter, local market factors in Phoenix—including population growth, infrastructure investment, and a favorable business climate—continue to offer long-term upside for discerning investors.

Sector Highlights: How Phoenix CRE Segments Are Adapting

Industrial: Global Pressure Meets Local Strength

The industrial real estate sector in Phoenix is closely tied to international trade, making it particularly sensitive to tariffs and global supply chain disruptions. However, Arizona’s role as a logistics and distribution hub positions it well for resilience and growth.

One of the most significant drivers is the continued expansion of the semiconductor industry. With TSMC’s $165 billion investment in north Phoenix, industrial demand in that corridor has surged. Properties that traded for $150–$170/SF just two years ago are now commanding $325–$350/SF. As companies continue to prioritize domestic warehousing and flexible supply chains, Phoenix remains a strategic industrial hotspot.

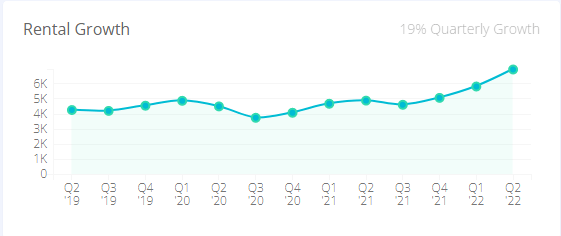

Multifamily: Stabilizing After Correction

Multifamily properties are not directly impacted by tariff policy, but they are influenced by construction material costs and general economic sentiment. Despite some headwinds, the Phoenix multifamily sector is showing signs of stabilization.

Investors remain interested in the region thanks to strong job creation, in-migration, and the ongoing need for housing. With pricing leveling off after a period of adjustment, Phoenix multifamily assets remain attractive for those seeking long-term performance and portfolio diversification.

Retail: Value-Add Investors Stay Active

Retail in Phoenix has proven more resilient than expected, particularly in the value-add space. A 90-day pause on new China tariffs (announced May 12) gave some breathing room to retailers and developers concerned about price hikes and consumer behavior.

Despite challenges, activity continues in the repositioning of smaller neighborhood centers. Investors are re-tenanting, redesigning, and upgrading properties to attract modern retailers and boost traffic. Phoenix’s retail sector may be evolving, but it’s far from stalling.

Office: Pockets of Strength in a Mixed Landscape

The Phoenix office market experienced a slight slowdown in Q1 after nearly two years of leasing momentum. Much of the hesitation reflects national trends around hybrid work, inflation, and long-term occupancy planning.

That said, Arizona has largely avoided the dramatic federal property closures affecting other markets. Fewer than 50 government-leased properties in the state are currently slated for closure. Demand from healthcare, legal, and professional service tenants continues to support leasing in key submarkets, particularly for adaptable Class B/C spaces with repositioning potential.

Outlook: Strategic Planning for a Shifting Landscape

Phoenix remains one of the country’s most dynamic and opportunity-rich CRE markets. Tariffs, tax policies, and macroeconomic shifts will continue to impact investment decisions—but market fundamentals, local growth, and asset-specific strategies are key to success.

Whether you’re seeking to acquire, reposition, or exit assets in Phoenix, the market still rewards thoughtful investment and long-term planning. Adaptability, diversification, and sector-specific insight will be essential in navigating what’s next.

Ready to Strategize Your Next CRE Move?

If you’re exploring opportunities in the Phoenix commercial real estate market, our team at R.O.I. Properties is here to help. From industrial and multifamily to office and retail, we specialize in both traditional and special asset services—offering insight, experience, and results.

Learn More About Our Full-Service Brokerage Firm

Contact Us