For the fifth year in a row, the Phoenix metro area ranked as the fastest-growing city in the United States, according to the US Census Bureau. Over the past decade, Maricopa County’s population has increased by 15.8%. In the process, the growth rate for Phoenix investment properties has also created top opportunities in Arizona.

Behind the growth is Phoenix’s appeal as a business-friendly destination, which has spurred local investment as well as out-of-state interest from pricier coastal markets in California, such as San Francisco, Los Angeles, and San Diego. There are several factors at play: Valley Partnership recently noted that companies can save an estimated 30% or more compared to Southern California. Phoenix has a robust transit infrastructure, low-cost land, few natural disasters, reliable power, and a growing workforce. And, of course, tax incentives and other initiatives by city leaders in the Valley have helped attract headquarters, strategic acquisitions, and development.

The Current State of the Phoenix Commercial Real Estate Market

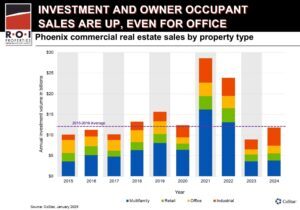

Arizona Commercial real estate is divided into four different asset classes—industrial, office, retail, and multifamily. Here’s a quick summary of the current state of the Phoenix commercial real estate market as of the end of 2021.

Industrial real estate in Phoenix

This sector has been a standout in recent years, thanks to the trend of consumers ordering online, with ever-increasing compressed delivery time, giving rise to strong demand for “last mile” delivery. The pandemic further fueled demand for warehouse and distribution space in Phoenix, with investors leveraging lower land and building costs, easy access to highways, rail, and air, and infrastructure. After a record year for demand in 2020, this year has been even better for industrial real estate, with tenants expanding their footprints at an unprecedented pace. Amazon alone inked 13 leases from January 2020 through June 2021, in addition to ground-up construction such as a 2.3 million-SF robotics fulfillment facility in Goodyear.

Retail real estate in Phoenix

Retail has largely recovered from the disruption caused by pandemic restrictions. Boosted by pent-up demand and consumers armed with stimulus checks, retail leasing in Phoenix is approximately back to pre-pandemic activity levels. Vacancies ticked up slightly in the first half of the year, but robust absorption in Q3 2021 and the demolition of over 1 million SF in retail properties has brought vacancy rates to pre-pandemic levels as well. Looking ahead, the retail market will have divided potential, which means investors need to take a targeted approach. Discount, grocery, drive-thru, and service-based retailers will continue to expand, while other retailing segments will continue being challenged by e-commerce and evolving consumer expectations and preferences.

Office real estate in Phoenix

There’s no sugar-coating the situation in office space, with Phoenix recording its weakest performance since the Great Recession. Vacancy rates and available space are up; in addition, a significant percentage of leases are coming due in the next few months, which could increase direct and sublease office space. If you’re looking for optimism, leasing activity has increased, and asking direct lease rates and average gross rates have risen in all three property classes this year. The prospects for this market will remain uncertain while businesses formulate work-from-home/hybrid working strategies and reduce their footprints to save on expenses.

Multifamily real estate in Phoenix

Like industrial, Phoenix multifamily real estate performed well through much of the pandemic, and vacancies have compressed below 5% in all three property types. The boom in Phoenix population has caused historic demand for apartments for rent, which has been compounded by historically low single-family housing inventory. Not surprisingly, 12-month asking-rent growth and effective rent growth in Greater Phoenix have soared to the highest rates in the country, in excess of 20%. Phoenix multifamily cap rates have been on a multiyear downward trend, with all property classes currently below 4.5% and only a modest rise forecast for the coming years. Two important caveats for would-be multifamily investors: 1) Almost all new construction is in luxury, Class A product, so competition is stiff, and 2) a significant number of units are currently under construction and will be hitting the market and adding to supply and competition.

What to Look for in Investment Properties

What to look for in an investment property goes far beyond the purchase price—it’s about the income potential and return on investment (ROI) that you hope to achieve over the long haul. This type of investing is highly dependent on your own personal goals and appetite for risk, among other factors, but the following guidelines offer a good starting point.

- Run the numbers: Three different methodologies are used to evaluate income-producing properties. The first is market comparable sales, i.e., comparative closed sales and listings against the property being valued. The second is reproduction cost, i.e., the cost of reproducing a given building. The third is income capitalization, which focuses on actual and projected income stream. (For more detail on the process, please see Thinking Caps: The Basics of Valuing Income Properties.)

- Appreciation potential: Again, this depends on a number of factors, including the sector, location, and overall market. One of the obvious ways to increase the appreciation is to invest in improvements and amenities—but don’t overdo it without considering the rents you can charge or at the expense of your ROI. Finding an undervalued investment in an up-and-coming area can be tricky, but a real estate expert can help significantly.

- Location: There’s a reason “location, location, location” is a time-honored real estate adage, and it’s important in Arizona commercial real estate properties too. A few questions to ask: How accessible is the building from adjacent streets and how much traffic is there? Are there any easement issues? How well are nearby businesses doing? Are there any that would be in direct competition with your property or its tenants? What are the crime rates?

- Weigh single-tenant vs. multi-tenant properties: As you’d expect, single-tenant properties are generally the simplest to manage and most stable—but keep in mind that the loss of that one tenant also means no income until you secure a new one. A net lease (a.k.a., triple net lease or NNN) is a popular option that provides steady cash flow while the tenant pays all taxes, insurance, and maintenance costs. Multi-tenant real estate such as retail or office is inherently more complex. While it can be lucrative during times of full or near-full occupancy, there is risk inherent in any space where tenants will come and go. As noted above, multifamily real estate has been red hot in recent years, but it is also highly competitive—and no boom lasts forever!

Common Property Investing Mistakes to Avoid

Each property and every deal will be different, with their own pluses and minuses, but here are three of the most common property investing mistakes to avoid:

- Neglecting due diligence: Unlike a residential home purchase, investing in commercial assets requires far more than qualifying for a loan, doing a home inspection, and moving in. As a result, enlisting the help of commercial real estate professionals in the search and negotiation process will make sense for less experienced investors. Depending on the type of property, critical research could include market reports, appraisals, rent rolls, discussions with tenants, tenant estoppel certificates, surveys, tax information, zoning, and environmental and soil reports. Working with a qualified property inspector will help uncover issues that need to be addressed, such as plumbing, heating and cooling equipment, a leaky roof, mold or asbestos, and more.

- Overlooking key financial issues: Even the most attractive and well-located property needs to pencil out in the near and long term, including contingencies. It’s not just a building—it’s a business! At the time of purchase, that means being aware of potential tax issues or title issues that could increase your closing costs, as well as whatever capital is needed for renovating the property to bring it up to standard. Over the longer haul, vacancy rates, rental rates, and loan rates will fluctuate, so you have to plan for possible worst-case scenarios. Above all, make sure that the seller is providing actual numbers rather than using pro forma or projected income and expenses. Depending on whether you’re investing in retail, office, multifamily, or industrial space, there are a wide range of additional considerations that a real estate professional can advise you on.

- Failing to create a team: Commercial rental properties require a significant investment of time as well as capital. It’s important to go into the process with a clear vision of the aspects that you want to handle yourself vs. those places where you need to enlist the help of an expert. Depending on the property or properties in your portfolio, building your team could include a wide range of professionals, most importantly an experienced commercial real estate broker, a lawyer who specializes in real estate law, financial and tax advisors, and a lender who handles commercial assets. If you’re committed to making property improvements, a reliable, licensed and bonded professional contractor is a must. Finally, if you want to save yourself from day-to-day headaches, engaging a property management company may also make sense.

Browse R.O.I. Properties’ Investment Opportunities

R.O.I. Properties represent investors, owner-occupants, and fiduciaries in buying, selling, and leasing commercial real estate throughout the Greater Phoenix market, and the state of Arizona. We are full-service real estate brokers who handle all commercial asset classes, and would welcome the opportunity to work with you on your investment requirements.

To view investment properties for sale in Phoenix available through our brokerage, our commercial property search tool will get you started. Search options include the ability to select by property types, building size, and price range. Be sure to contact us as well for off-market deals!

New investment opportunities are added to our listings on a regular basis. In addition, our team of real estate professionals keeps a close eye on top real estate markets throughout the Valley and can help you identify available properties that meet your financial needs and goals, whether through on- or off-market deals.

Contact R.O.I. Properties

Ready to jump into the Phoenix real estate market? Contact us today to learn how we can help you find the perfect investment property: [email protected] or call 602-319-1326.