In This Article:

- What is a NNN Lease?

- What is NNN in Renting Retail Space?

- What Does NNN Mean in Office and Industrial Spaces?

- How do you Evaluate a NNN Lease?

- Could a Sale-Leaseback Be the Right Move for Your Portfolio?

Interested in learning more about NNN sale-leaseback investments or triple-net lease deals? The experts at R.O.I. Properties have your answers.

What is a Triple Net Lease?

A triple-net lease deal (a.k.a., NNN) is a lease agreement in which the tenant is responsible for all expenses, including rent, real estate taxes, insurance, and maintenance. These types of deals are increasingly being sought out by investors who are 1031 investors and/or those who are seeking low management.

A subset of triple net-lease deals is the sale-leaseback, which gives a commercial real property owner the ability to convert equity into liquid capital. In this type of transaction, the seller relinquishes ownership rights to an investor and then leases back the property when escrow closes. For the seller, the influx of cash from a sale-leaseback can be used to reduce debt, improve debt-to-equity, or fund future expansion—or even to prepare for a business sale or retirement—while maintaining control of operations. For the investor, it creates a transaction that provides stable and relatively uncomplicated income.

What is NNN in Renting Retail Space?

The use of NNN retail started with large national brands, both franchises and corporate-owned stores. Typical NNN deal would be Walgreens, CVS, KFC, Taco Bell, Starbucks, etc. A developer may undertake a build-to-suit for this tenant, with a long-term lease in place upon occupancy. Then, the developer may retain ownership for a bit, then spin it off to investors with the long-term lease in place. Subsequently, there could be several generations of investors who sell and buy with the national (or regional or local) tenant remaining in place over many years. As the popularity of such traditional, national-tenant NNN deals has risen, so has the competition for them.

Because the buyer base for NNN is so robust, demand for these types of “mailbox money” deals has expanded tremendously and investors are looking for alternatives. In many instances, they are 1031 deals coming from an investor buying or selling management-intensive assets such as apartments or multi-tenant dwellings, looking to move into something that’s easy, plug-and-play, and offers a nice return.

NNN Retail Trends

A few of the trends we’re seeing in NNN properties in Arizona:

- Traditionally, NNN leases have been 10 to 15 years, but we are seeing a trend toward more flexibility where they can be as short as 5 years.

- Another interesting development has been the acceptance of other asset classes besides retail, including office (medical, veterinary and professional services), industrial, and special use (schools, gyms and medical).

- As noted above, for decades the in-demand NNN retail product was national credit, for example Walgreens, CVS, Taco Bell, Carl’s Jr., McDonalds, or Starbucks. That has now evolved into its use within regional credit—on the retail side, think names such as Filiberto’s, Garcia’s, Serrano’s, and Oregano’s.

- On a local level, sale-leasebacks have carried into physician practices on the medical side and local industrial businesses and local restauranteurs, etc.

- The NNN trend also has benefited from businesses and investors migrating out of California—giving them the ability to exit certain asset classes in the Golden State into sectors that offer more upside in Arizona NNN properties.

- The types of investors interested in such deals has also expanded along the way. No longer restricted to large institutional organizations, even private and smaller family investors have become more active in the Valley’s NNN scene.

On a national level, industry experts are carefully watching for the impact of rising interest rates and debt costs. Although the expectation is that NNN cap rates will increase in the coming 6 to 18 months, capital flow into net lease deals is anticipated to remain strong.

What Does NNN Mean in Office and Industrial Spaces?

For business owners in the office and industrial space in the current environment, the sale-leaseback concept can be particularly useful. It enables them to peel off real estate assets and then reinvest in their businesses—lessening their risk while they recapitalize.

Industrial NNN and Office Trends

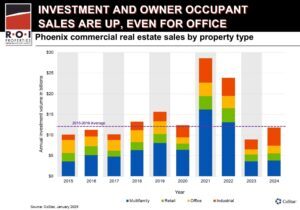

Beyond retail NNN, industrial and office properties warrant specific mention. For industrial assets and real estate for lease in Phoenix, sales volume in 2021 reached an all-time high of $5.1B, up nearly 70% from the previous year, while office asset sales volume in 2021 reached $3.4B, up from $1.6B in 2020. Because of soaring industrial demand, investors need to be aware that many industrial properties are currently overpriced, which includes paying a premium for a triple-net industrial building.

In the office sector, office space for rent in Phoenix like medical buildings are in high demand, but the overall trend comes down to investors wanting to be in Arizona. Any local businesses or regional businesses that are located in Arizona—law offices, accounting offices, contractors, etc.—may be viewed as an opportunity for an NNN structure.

How do you Evaluate a NNN Lease?

Although triple net lease deals are generally a win-win transaction, it’s important to be aware of the risks as well as the rewards. For an owner in a sale-leaseback, of course, it means relinquishing your ownership rights, along with the potential for a loss of residual value and appreciation—although that can be mitigated by reinvesting the proceeds into areas where you can drive better return on investment.

For an investor, the risk comes primarily from nonperformance by the tenant. In these types of transactions, vetting the tenant to ensure they will be in business for the duration of the lease and beyond is paramount. This can be mitigated by acquiring an asset with multiple exit strategies, but the most important protection comes from performing the proper financial analysis and due diligence.

Beyond the significant premium for a national brand within NNN properties in Arizona, there are several issues to be aware of. First and foremost, a franchisee represents more risk than corporate owners, for financial reasons among others. Second is to be alert to lease structure. For example, a deal may be portrayed as a triple-net long-term lease, but if a tenant has a right to terminate early, that is not a true 30-year lease—effectively, it might be only five. And third, there may be other hidden loopholes that increase liability. For example, a tenant is responsible for taking care of taxes, insurance, and maintenance, but they’ve carved off certain structural repairs, such as the roof, parking, or systems like plumbing or HVAC.

Depending on how much is carved out, it might technically be called a triple net lease, but it is not an absolute triple net lease. An absolute triple net lease is where the investor does nothing but run to the mailbox to pick up their check.

Regardless of sector, NNN deals have certain commonalities. Vetting a prospective tenant is very important across any and all asset classes, whether it’s a sale leaseback or a general triple net lease for an investor.

Here are a few of the financial elements to take into consideration:

- Particularly with local credit or regional credit, you want to make sure you have good guarantees in place. A big business is likely to have a more established track record than a startup.

- Knowing and understanding the business is non-negotiable, starting with at least three years of financials. Can they afford this rent? Is it similar to what they were paying before? What does their EBITA look like?

- Do they have a good story to tell, and look like they are going to be in business for the long haul? No matter what asset class you’re looking at—retail, office, industrial, nonprofit, etc.—you want to be confident about what makes them viable now and 20, 30, or 40 years from now beyond the term of the lease, because that will be important if you have to sell the property. If you have a 10-year lease and want to sell in year 6, an investor will want to know if the tenant is financially solid.

- Is their business recession-proof and inflation-resistant? If their revenues have fluctuated over the years, you want to understand when and why. Value fluctuation is a significant risk for NNN investors, and you want to ensure that you’re making a deal with a steady Eddie, not cyclically tied to a business that will struggle making its payments when economic pressures arise.

Learn More About Our Full-Service Brokerage Firm

Contact Us

Could a Sale-Leaseback Be the Right Move for Your Portfolio?

Whether you want to raise capital from a property you own or are interested in NNN properties in Arizona, the team at R.O.I. Properties is ready to help you formulate a sale-leaseback and/or NNN strategy that aligns perfectly with your business goals. Explore triple-net lease opportunities today. For more information on NNN properties in Arizona contact us today at [email protected] or 602-319-1326.