As post-pandemic social restrictions start to ease with the arrival of vaccines, plus the most recent round of stimulus funds, we are beginning to see glimpses of what recovery looks like in the Valley of the Sun. This month, the Arizona Office of Economic Opportunity announced that the state’s labor force has officially risen higher than it was prior to the pandemic, and at 1.8%, Arizona’s population growth was 4 times larger than the U.S. growth rate of 0.4%. The metrics are promising for small businesses, with Greater Phoenix ranking #1 in the country in annualized wage growth (up 5.67% vs. April 2020) and #3 in small business job growth (up 4.6% for the same time period).

Here’s the current view of several key commercial property sectors:

- Hotels in recovery mode. The story here is pent-up demand and significant increases in occupancy rates. Even with limited crowds, according to new statistics from the Arizona Office of Tourism, Phoenix had the highest hotel occupancy in the top 25 markets at 77% for the week of March 14. In particular, resumption of business and leisure travel are expected to give a boost to higher-priced properties, with occupancies assisted by generous staycation offers in the Valley over the summer season. Part of the ongoing challenge in hospitality, however, will be staff shortages. In response, many Phoenix resorts are offering higher wages and other incentives to help fill the gap.

- Retail regional malls trend to mixed-use. In March, Christown Spectrum announced plans to add residences, a hotel, entertainment and high-rise business offices on the 98-acre site. The Paradise Valley Mall’s redevelopment plan includes a mix of residential and commercial buildings, including apartments, office space, a grocery store, restaurants and retail stores. Scottsdale Fashion Square recently completed a multi-year redevelopment that includes new-to-the-market tenants, remodeled stores and services such as pickup for online purchases, expanded restaurant patio seating, and shopping by appointment. Plans for Metrocenter Mall have not been disclosed yet, but likely include adaptive reuse with a mix of uses as well.

- Big box retail spaces shrink or vacate. Convenient locations and large open spaces have proved these sites as a good solution for last-mile distribution warehouses and fulfillment centers for retailers. Amazon, of course, had adopted this strategy long before the coronavirus, but we are also seeing them repurposed for uses such as municipal facilities, charter schools, worship sites, recreational centers, etc. Phoenix currently ranks at the top of the nation in big-box leasing activity, due to inbound migration and the resulting need for last-mile industrial space.

- Neighborhood retail centers focus on services not products. With retailers struggling to beat their online competitors, neighborhood shopping centers (think grocer-anchored centers) are skewing towards services rather than shops with products. “Medtail,” a hybrid of retail and healthcare, fitness/health centers, educational sites, restaurants, and even residential units are among the options.

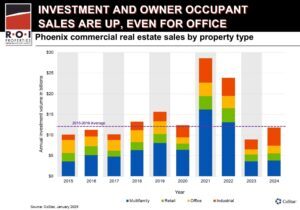

- Office still faces headwinds. The outlook is not so rosy in this sector, with vacancy rates lurking just below 15% and significant downward pressure on rents. COVID-19 will leave its most meaningful, deep and long-term impact in the office market, with sublease space growing and leases coming up for renewal. Most law firms, financial service firms and technology companies—among many others—are planning to shrink their footprints or incorporate office hotel/guest office concepts. Even with widespread discounts, vacancy rates are anticipated to climb in the coming two years or more—and tenants will continue to have the upper hand in negotiations.

As COVID-19 recedes in the rearview mirror, a new study from the Arizona Office of Economic Opportunity foresees our heady growth continuing: They project the state will add nearly 550,000 jobs through 2029, barring any new major economic or political disruptions. At a rate of 1.6% annualized growth, that’s expected to outpace the nation’s overall rate of 0.4%.

Investing in Phoenix Commercial Real Estate… or Looking to Sell?

R.O.I. Properties represents investors, owner-occupants, lenders and fiduciaries in buying, selling and leasing commercial real estate throughout the Greater Phoenix market and the state of Arizona. Whether you need help investing in properties (mainstream or distressed properties), we are full-service real estate brokers who handle all commercial asset classes. In addition, we serve as Fiduciaries through court appointments as Real Estate Special Commissioner/Special Master and REO broker. To put an expert advocate on your side, contact us at [email protected] or 602-319-1326.

Learn More About Our Full-Service Brokerage Firm

Contact Us