An Overview of the Housing Market in Phoenix, AZ

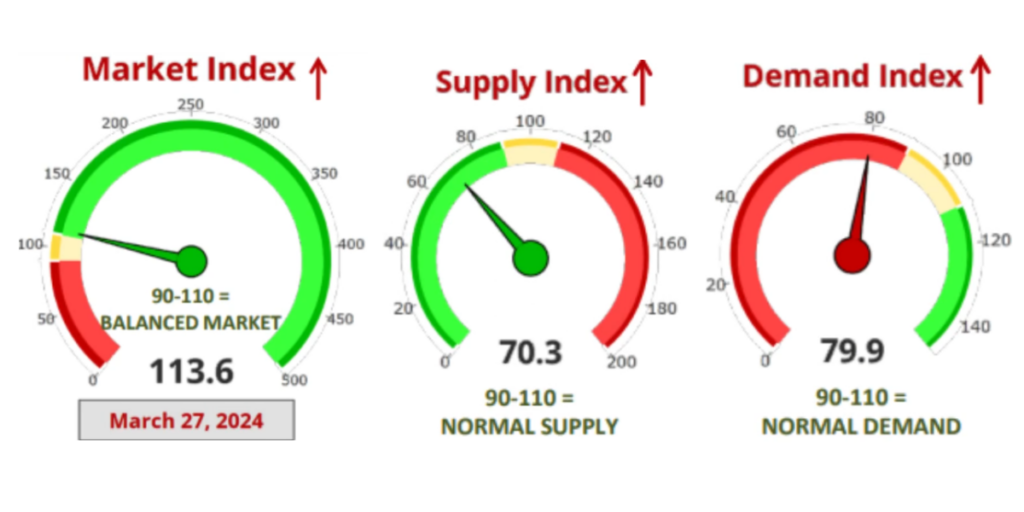

Groundhog Day kicks off the month of February, but like the Bill Murray movie, we continue to be stuck in a loop without much real day-to-day change in the market. In the first few weeks of the year, interest rates bumped above 7% once again, before falling again since the beginning of March. Inventory has held relatively steady—at historically low levels, about 34% below normal—while average sales prices hit all-time highs in January. Contract activity, which typically rises sharply from January through March, stagnated after rates increased and has been underperforming in comparison to 2023. Technically, we’re in a slight seller’s market, but buyers are seeing more negotiability and opportunity in some areas.

The market isn’t going to change overnight. The majority of would-be sellers remain locked in, without the ability to move up or down due to interest rates. On the demand side, potential buyers are dealing with interest rate levels and the appreciated pricing we’ve experienced over the past four years.

The Federal Reserve has stayed disciplined about tamping down inflation. Although the most recent inflation data came in “hotter than expected,” some market analysts believe the central bank could start cutting rates by the end of June—even if buyers would like to see it happen sooner.

Here’s a quick roundup of what’s happening in the Phoenix housing market:

Active Listings Up, But Still Historically Low

- New listings for January exceeded last year by 16%. That was the highest January since 2020 in Greater Phoenix, but the fourth lowest in 24 years for Greater Phoenix.

- Supply rose 10% in the first 6 weeks of the year, but the figures vary widely by home type and price range. Condo/townhome and mobile home listings were up 17% and 15%, respectively, while single-family homes were up just 8%. Listings above $1M were up 21%, while mid-priced listings between $300K-$600K were up just 5%.

Demand Running Below Normal, But Better than December

- At 22% below normal, listings under contract and closed sales were still an improvement over December 2023, which was 31% below normal.

- 44% of February closings involved seller-paid closing costs, including mortgage rate buydowns. FHA financing is on the rise in the $300K-$600K bracket, with about a third of buyers using it compared to 9% two years ago.

- The market over $1M, which is less influenced by mortgage rates, is having a strong spring season. Listings in escrow are as high as they were in the record year of 2022, despite more than three times the inventory (2,500 homes) being available.

Learn More About Our Full-Service Brokerage Firm

Contact Us

View this post on Instagram