The commercial real estate market continues to experience headwinds, and Class C multi-family rental properties are starting to feel them the strongest. There are a number of factors behind that dynamic. Because these tend to be more affordable units, the target audience is, unfortunately, more subject to layoffs and other types of job loss—which means many owners are not achieving full rent payment on their rent roll.

On the other side of the equation, the owners of Class C properties are getting squeezed. These properties are often financed through community and regional banks, which may not provide foreclosure forbearance. These loans are different than those funded by GSEs or other federal agency loans, where foreclosure moratoria are in place.

Class C properties have experienced significant appreciation in the last several years, and there is current market demand from local as well as California buyers. This may change, as market conditions fluctuate, but a unique opportunity to take advantage of higher pricing exists now, for the following reasons:

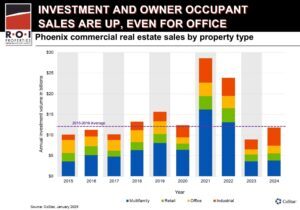

- The Greater Phoenix market is still working off of higher pricing, fueled by high comparable sales and low cap rates. This is the strongest factor in favor of selling sooner rather than later, as long as that is what fits your strategic plan.

- There is ample 1031 Exchange money seeking to place in the Greater Phoenix Market, assisted by the extension of deadlines for nominating and closing on up-leg properties in a 1031 Exchange. For more details, please see our recent post, 1031 Exchange Transactions: New IRS Deadline Offers ‘Rona Relief

- Multifamily demand is still historically strong in Greater Phoenix, and there are still investors looking for desirable properties and opportunities—particularly if they are simply trying to get ahead of the inevitable recovery.

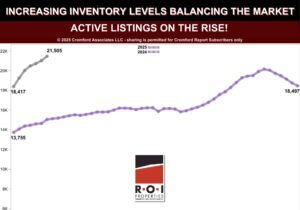

Although the commercial real estate market tends to move fairly slowly, CoStar is anticipating U.S. apartment vacancy rates to hit record highs in the coming months, and there are approximately 15,000 multi-family units currently under construction. This is an occasion where pushing forward disposition plans may make a long-term difference for sellers to capture current equity.

If you own a Class C multifamily property and want an advocate on your side to achieve the highest pricing and smoothest deal, contact R.O.I. Properties at 602-319-1326.