In one of the more highly anticipated Federal Reserve meetings in recent memory, rates were reduced by 50 basis points to 4.75%–5.00%, exceeding the expectations of market observers who were betting on a more modest 25-point decrease. Naturally, some of the drop had already been built into mortgage rates for buyers who had been pre-qualified. At the end of September, the average 30-year mortgage had fallen to 6.08%, although rates ticked up to just under 6.3% as of October 7. Buyers who have a relationship with a bank (such as having other funds on deposit) may have opportunities to slice a bit off from there.

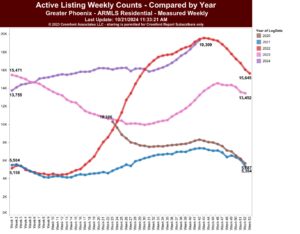

With interest rates coming down, it provides some optimism that people can afford to finance a new property and move after being home-locked for years. For every 1% decline in rates, principle and interest payments across the board drop 10%, equating to hundreds of dollars in monthly savings for borrowers. As of the most recent ARMLS figures, inventory levels have exceeded 19,000 units on the market. Although that represents a 45.8% increase from the same time in 2023, keep in mind that a typical Phoenix residential market in equilibrium is around 22,000–23,000.

Demand on the Upswing—Will Supply Follow?

It is unclear exactly how lower rates will affect the market in pricing and inventory dynamics—and the bigger question is how buyers will react during the fourth quarter of the year. While most families are probably settled in for the school year, some may dip into the marketplace given more appealing rates. Subtle evidence shows demand is already improving: On October 1, the Phoenix Business Journal reported “buyer demand has picked up 11.5% from just three weeks ago, most notably between $300,000 and $800,000, where mortgage rates are more influential.”

This also presents an opportunity for agile sellers who might have been on the fence to get their properties on the market before more product hits the market and the holiday lull.

If enough would-be sellers make a move, however, that means that we could have a lot of inventory—and competition. Although a flood of product is a concern, it bears noting that the current environment is quite different from the 2007-08 rate decrease period. Back then, there was a significant amount of money washing around on the market and loose underwriting standards (such as stated loans, with no income verification). In today’s scenario, banks are being cautious.

Beyond the Fed’s moves, the bond market uninverted this month, with the 2-year bond yield falling below the 10-year Treasury for the first time in nearly 2.5 years. This is a correction that has long been expected and is often the precursor to a recession. Ironically, periods of recession have proven to be good for homebuyers, since mortgage rates typically decline and home appreciation stagnates.

Learn More About Our Full-Service Brokerage Firm

Contact Us