Phoenix is not alone in experiencing challenges in its commercial real estate markets. Office assets are troubled nationwide, with prices down, subleases up, and investors and banks sitting on the sidelines. Multifamily, which was the CRE industry darling for years, is experiencing a price decline in many parts of the US, while the Valley’s market has several caution signals blinking. As a result, we are seeing price discovery occur across all commercial asset classes, particularly in the office and multifamily markets. Comparing previous sales to the most recent sale price is one way to get a handle on what we might expect going forward.

Even prime office assets, located in the most coveted submarket in Phoenix (Camelback Corridor) and that have been able to increase their lease rates, are seeing price declines.

- For example, 2375 E. Camelback Rd. (308,827 SF) sold for $100 million in June 2018, and sold for $86 million in April this year—a 14% decrease.

- Some areas are being hit even harder, such as the Central Ave. Corridor: 3200 N. Central Ave. sold for $49 million in November 2016, and sold for $24.5 million at the end of May—a 50% drop.

- In a less prominent area, 4801 E. Washington experienced a 47% decrease from November 2018 to this June.

And, these are just a sampling of the deals that have sold. With very few transactions closed, we are just beginning to see what the market is telling us about price discovery. In addition, a recent article in Axios Phoenix noted an interesting dynamic in the Valley office market: Although nearly a quarter of the office space is vacant, there is significant employer demand for high-end buildings.

CFOs and CEOs are experiencing resistance as they ask employees to get back to work. Multi-tenant offices are a difficult asset to work with, even if they get repositioned or repurposed. Owners need to wait for leases to term out (or for tenants to accept a buyout), or to bring in new tenants, usually with discounts. Meanwhile, the capital markets are not offering financing on many opportunities because of the risks and high vacancy rates; deals that are being done are all cash. While default rates increase, lenders are working with their borrowers/office owners, as these assets are complicated to manage through to repurposing.

Based on the most recent forecast, it may be a year or more before we truly find a floor in sales price and price/SF.

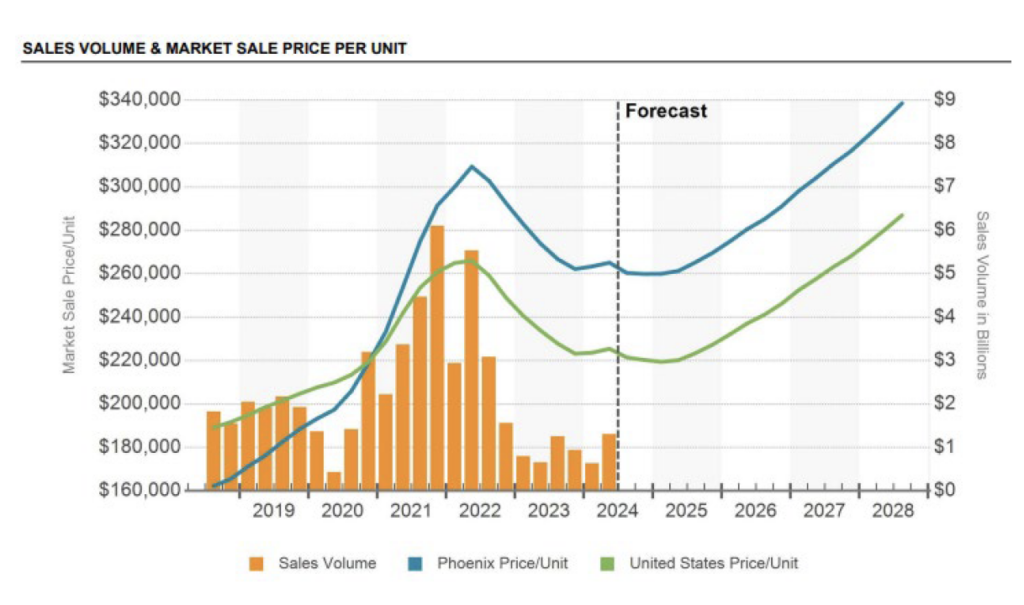

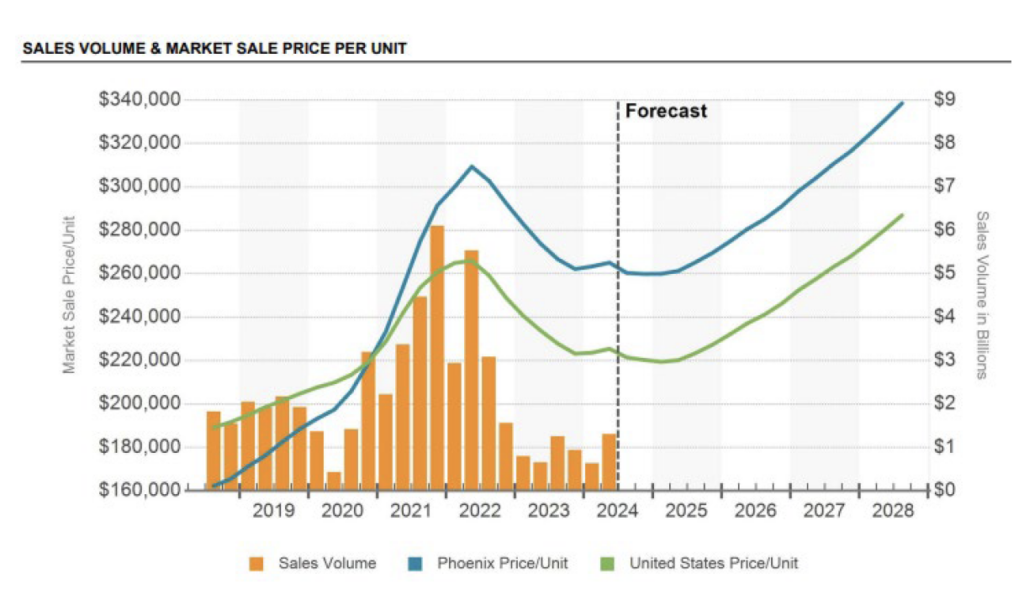

Price Discovery in Multifamily

While office has been experiencing turbulence ever since the pandemic, multifamily’s market peak occurred more recently, in the range of late 2021 to early 2022. During the past 12 months, developers delivered 20,000 net new units—nearly triple the pre-Covid average—putting pressure on the market and pushing vacancies to 11%. What has price discovery looked like in the multifamily market? Recent sales have included:

- 3213 E. Flower St. in Phoenix, a 20-unit property that fell from $15 million to $10.5 million in just under a year

- 15501 N. Dial Blvd. (285 units), which sold for $117 million in May, a 10% drop since July 2021

- 15509 N. Scottsdale Rd. (240 units), which fell almost 34%—$145 million to $96 million—from May 2022 to March 2024.

While we have clearly fallen from the peak, we do not know if this is a bottom (although the forecast shown in the chart below indicates the worst is likely over). What we do know is that there is value in the marketplace—and that there are property owners who acquired at the peak and do not have equity at this point. Institutional interest has waned. More common buyers are private equity funds that are doing value-add deals for cash or more entrepreneurial well-capitalized private owners.

Why are owners willing to take such a significant haircut, rather than wait out the market? There can be a number of reasons, particularly for institutional investors—and they may not always be obvious. They may prefer to have a property off their balance sheet than to have to continue to throw dollars at a building that could require years of heavy lifting. Institutional investors may also be more influenced by what the market is telling them, or by what their investors are demanding, as opposed to the finances of a given property. What might look odd to the casual observer could be a result of rebalancing their portfolio or taking a different look at their asset load.

The positive news? While the big players may be steering away from various assets, entrepreneurial investors with a value mindset and cash may fare better in today’s market. With pricing coming down, there will be unique opportunities to buy well-positioned assets that will generate income and appreciate in value over time.

Learn More About Our Full-Service Brokerage Firm

Contact Us