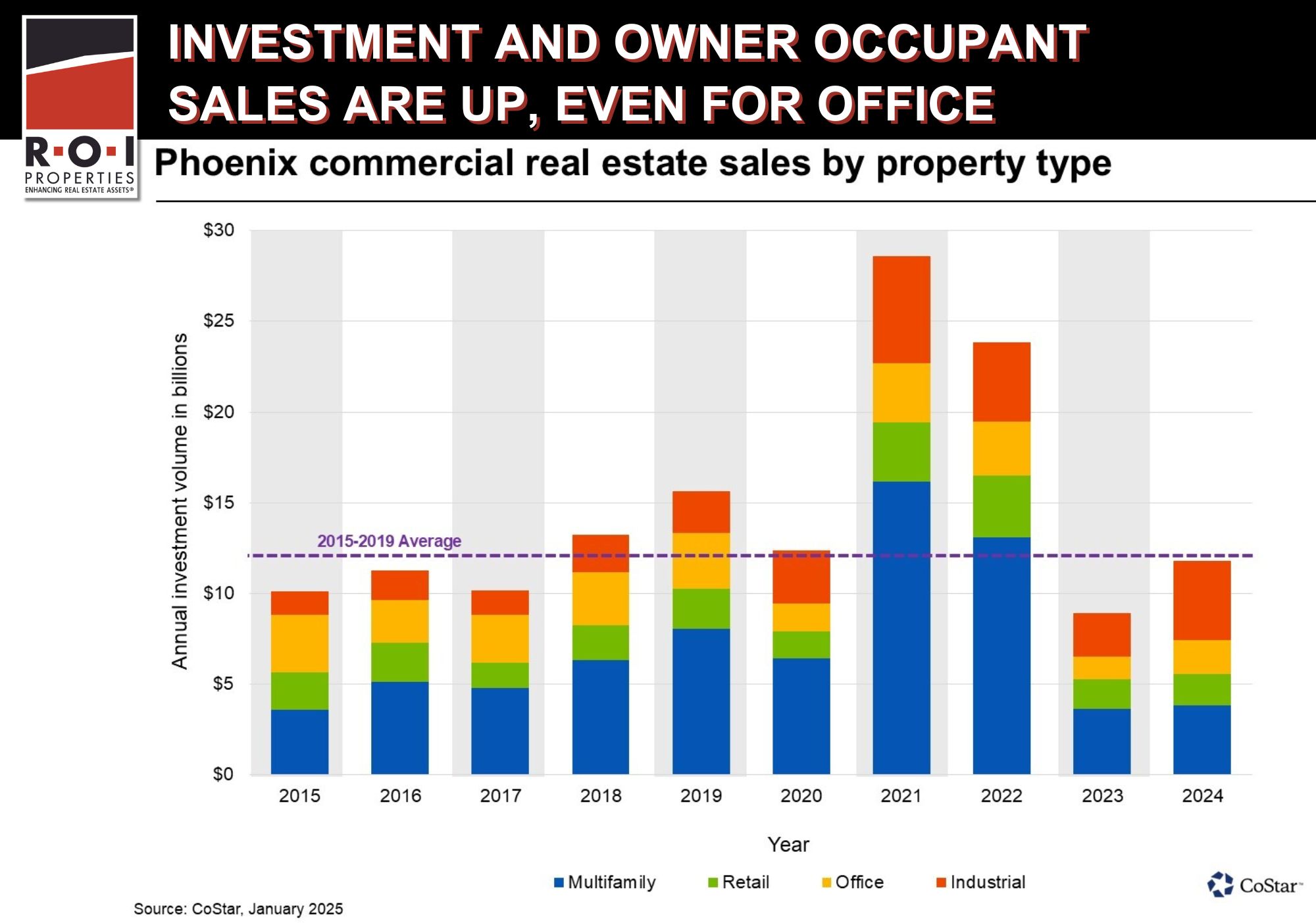

CoStar recently released its 2024 recap of the Phoenix commercial real estate investment market. When all was said and done, “about $11.8 billion worth of multifamily, retail, office and industrial properties traded hands last year, a 32% increase compared to 2023.” The year-end statistics are notable on several fronts: Sales volume was just shy of the 2015-2019 annual average ($12.1 billion) and well ahead of the nation’s overall performance vs. the same time periods. Another bright spot was that all four main property types showed year-over-year sales growth, led by industrial at a more than 80% increase over 2023. The second-best year-over-year performer was office, up 47% (although still 35% below the 2015-2019 average).

The broader third-party market statistics corroborate what our team is seeing on a more granular level in commercial sales and investment. We continue to see strong activity in industrial—so this is no surprise. What is perhaps more interesting is the strength in office assets for owner occupants. The activity is strongest in single-tenant properties—think dentists, physicians, acupuncturists—where service-related professionals need their own office space.

Opportunities for Owner-Users, Challenges for Multifamily

As noted in previous issues of The Real State, however, multitenant office buildings continue to lag. There are a few exceptions: Discount Tire’s purchase at Desert Ridge and U-Haul’s purchase in Midtown. Both deals were at heavily discounted pricing compared to what they would have commanded prior to the pandemic, and what was technically multitenant/investor product is better described as owner-user sales as executed. While this is an illustration of distress, it also shows how larger owner-users looking to occupy an entire building have power and opportunity within the current marketplace.

Finally, although multifamily sales were up a modest 5% over 2023, we are also experiencing an uptick in the number of properties that have been noticed for trustee sale and foreclosure. Most often, these are assets that were acquired during 2020 and 2021: when the loans came due, they could not refinance, nor did they have any equity. Earlier this month, Neighborhood Ventures, a real estate investment company that uses crowdfunding for investing in multifamily properties, entered into a contract on Venture on 52nd Street, a 71-unit multifamily property in lower Arcadia. This was the first time Neighborhood Ventures has purchased a foreclosure—the $11 million deal represented a 35+% discount from its 2022 valuation of $18,250,000.

While there is a modest amount of distress in some special-use properties, unique properties, and land deals, it’s clear that multifamily remains on the most challenging path of the major CRE sectors.