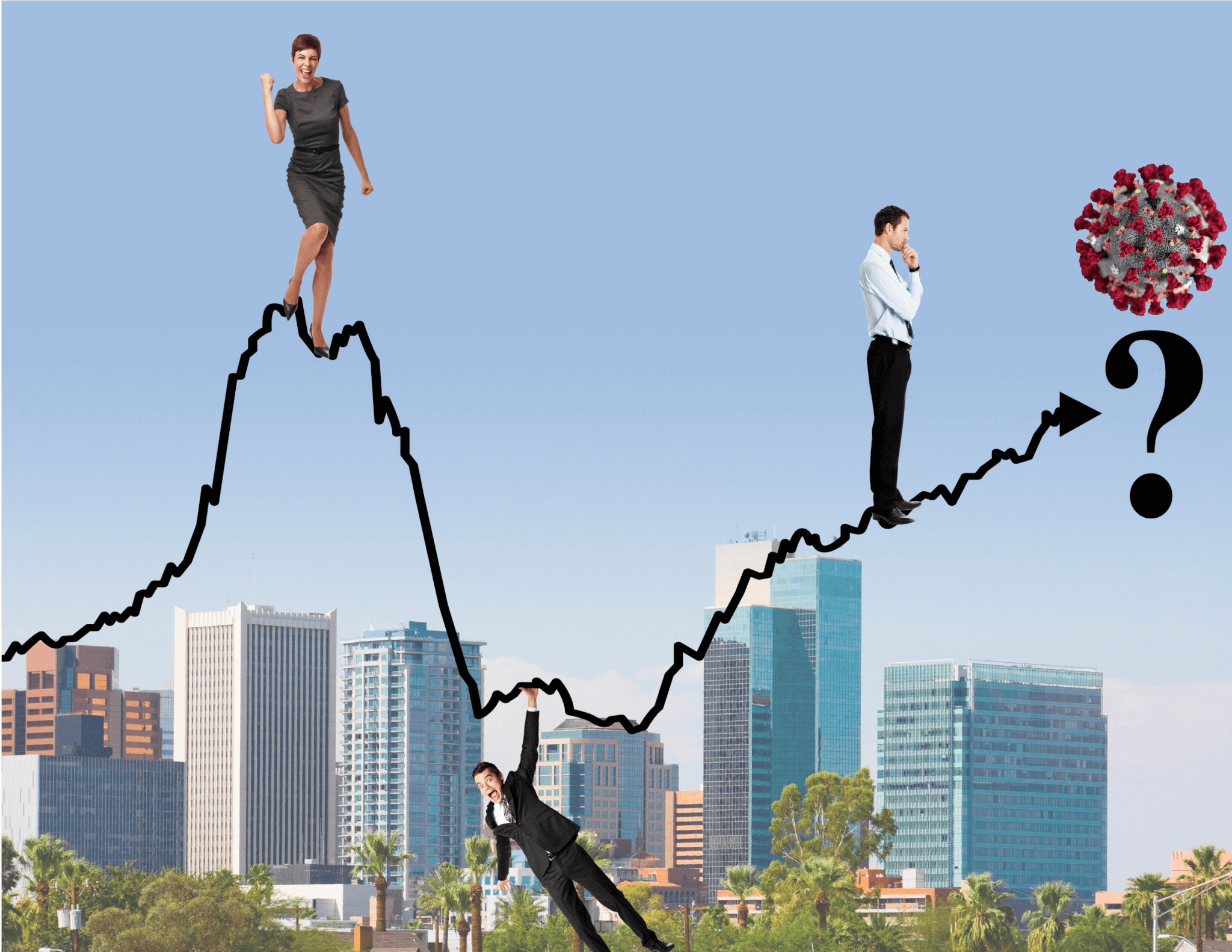

While the impact of the COVID-19 pandemic has been sharp and dramatic for financial markets and residential real estate, commercial real estate tends to move more slowly during times of disruption. Notwithstanding, we are seeing some deals cancel due to concerns regarding the economy, and it is certainly getting more difficult to get deals financed. The commercial deals that seem to be “sticking” are owner occupant office and industrial product. Investor deals seem to be frozen, with investors anxiously waiting to see how all of this shakes out, and downward pressure in almost every asset class.

The landscape seems to be shifting with every announcement by federal and state authorities, and each tick of the Dow. With that in mind, here are a few of our observations:

- Some market experts indicate we will see a trough in April, followed by a recovery soon after that. While we want to be optimistic, we also need to be realistic: Foreclosures will be stalled and rent payments will be deferred, and it will likely be July/August before the full state of the market is clear.

- Similarly, the most sanguine view of commercial real estate investment is that it is not as volatile as the stock market, and the lower cost of capital offers an opportunity to significantly increase your returns. Historically, periods of recession and stock market turmoil have also led investors into hard assets for predictable returns. That rosy view, however, needs to be balanced with the potential for price drops in assets and erosion of equity.

- The financing of transactions is in a difficult period, as lenders assess what’s in their pipeline, how to value properties in a declining market and what protections to put in place to ensure performance. Marginal borrowers are going to face some serious headwinds. Additionally, equity requirements are already increasing, along with additional assurances, including heavy interest and expense reserves.

- Several sectors are already experiencing significant changes/challenges:

- Multifamily: We have been cautious about multifamily in recent years, and there’s no way of sugarcoating the situation: It is going to be a problem if tenants can’t pay the rent. Additionally, it will be difficult for the Greater Phoenix area to digest existing inventory with unemployment increasing, and the 15,000+ units that are currently under construction (most of which is Class A product, with luxury amenities).

- Retail/Hotels: After several years of growth, retail (particularly restaurants) and hotels are getting hit particularly hard during their high season. Weaker operators will likely not survive, and this will be an opportunity to re-tool, for those who endure.

- Office: The nationwide experiment in working from home—and learning to Zoom on the fly—may have long-lasting effects on the office market. Based on early indications, we can anticipate a trend toward cohabitation and/or direct sublease.

- Net Lease: Investors’ appetites for net-lease properties will be dependent on the financial stability of the tenant. Overall, we would anticipate cap rate increases and downward pressure on pricing.

- Industrial/Warehouse properties seem to be faring well, with continued and likely increased demand, with many of us ordering goods online instead of shopping. The supply chain can’t rest, even as we work through this!

- Tech remains a bright spot, as well.

- On a positive note, the US Small Business Administration has announced that businesses within our region will be available to qualify for interim financing at extremely low interest rates. We’ve already been talking with clients about that, and hope it can serve as a lifeline for many of them.

Knowing the toll the coronavirus is taking on the nation’s health and financial well being, it can be a tough time to be optimistic and make big decisions. R.O.I. Properties is committed to providing stability for our clients during periods of uncertainty, anchored by our 17 years of service in the Greater Phoenix market.

We know/understand the market, and are working hard to ensure that our clients thrive in every real estate market, and particularly as market conditions shift.

I can personally be reached at [email protected], or 602-319-1326, should you need assistance in understanding what is happening in the market or a specific asset class, and/or building your strategic plan for selling, buying or leasing your commercial real estate assets

IMPORTANT: The outlooks for individual commercial real estate sectors may change rapidly. For the most up-to-date information and analysis, please follow R.O.I. Properties on LinkedIn:

https://www.linkedin.com/company/r-o-i-properties

At R.O.I. Properties, we pride ourselves on continuously analyzing and keeping abreast of the market, to ensure that you can maximize your real estate Return On Investment (R.O.I.).