Getting into commercial real estate as an established or new business can be a complicated process. Rather than fear it, this article will help you think through factors for success.

When considering relocating and finding a property for your business, you have choices. The two main options are to buy the property where you operate your business, or lease a location.

Here are the factors to consider:

Advantages of Owning Commercial Real Estate in Phoenix

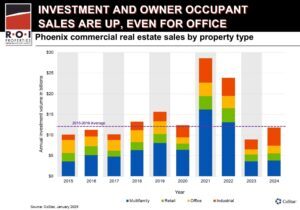

Appreciation

In growing areas like Phoenix, as demand for commercial real estate inventory increases, the value of the property also increases over time. Commercial property owners often have the luxury of realizing significant profits from a sale after holding the property for several years.

Debt Reduction

When a business owner pursues conventional financing for a commercial real estate purchase, the principal is paid off, and the business gains equity. This equity reduces the overall debt load on the company. Owning property and keeping up with your mortgage payments will give your business a solid foundation of credit over time.

Control

When you own the building that you occupy, you have full control over how the building is managed and the physical changes that are implemented. As your business grows and changes if you need to knock down walls or install new equipment you are free to do so.

Income

Parts of the property or the property in its entirety can be leased out to other occupants. Leasing generates a stream of alternative income for your business or owner. Additional revenue can be used to pay the mortgage, be saved for a rainy day, or for other projects.

Tax Advantages

There are many tax advantages to owning commercial property. For example, the amount of interest paid on your mortgage may be tax deductible as well as certain repairs or upgrades that would not be tax deductible if you were leasing a property.

Disadvantages of Owning vs Leasing Business Property

Time Frame

Business owners that chose to purchase commercial property for their businesses usually plan to stay at the location for a minimum of five years. Purchasing property locks you into a site for a longer time than the average lease.

You are also locked into a payment agreement with your lender, and these are usually 10-20 year obligations. Some may penalize you for paying the loan down early, although this is generally negotiable. In addition to this, you may have issues securing funding for things like an expansion if your business grows at a faster than projected pace.

Initial Capital Outlay

Purchasing commercial property is a bit different from residential property. Often banks and other traditional lenders are looking for a 20% to 30% down payment, but Small Business Association loans generally require only 10% down. A down payment can temporarily tie up a significant amount of working capital for a business.

Management Costs

Depending on the size and location of the property, building management costs can become a burden. Other issues include health and safety inspections, contractor management, and legal compliance.

Advantages of Leasing vs Owning Business Property

Location

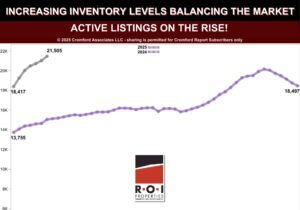

One of the main advantages to leasing business property is that there is often a wider variety of possible locations for your business. Many businesses that require a storefront and foot traffic may have limited choices when it comes to buying a property outright.

Flexibility and Mobility

When you lease space, you are only required to pay on the lease for the agreed upon amount of time. Leasing in a building with many other units allows for easy expansion into additional vacant space if you should need it as your business grows.

Availability of Cash

There is usually a smaller deposit (as opposed to a down payment) to lease a property. Not having to make a 10-30% down payment frees up cash flow for your business to invest in equipment and other items necessary for operation.

Source of Financing

Leasing property can help your business to grow a positive credit history if you keep up with your payments and on good terms with the lease. Your record of leasing can help you to secure financing to eventually purchase property or invest in your business in the future.

Stability of Costs

When you lease a location, depending upon how the lease is structured, you may not be responsible for extra costs such as building maintenance and other unforeseen expenses that can come up for property owners. Having few unknown costs on your balance sheet is positive in the eye of lenders. For example, if you are looking for a business loan, the stability of your overall costs will factor in your favor.

Tax Benefits

There may also be tax benefits to leasing, as your lease and occupancy costs may be deductible as business operation costs.

Focus

When a business leases a property, the company may not be responsible for overall maintenance and care for the property. The absence of these responsibilities, if the lease is structured in this way, leaves the business owner to focus solely on their business without the worry about the ins and outs of taking care of a property as well.

Disadvantages of Leasing vs Owning Business Property

Cost

A business with a strong balance sheet and extra cash flow to put down a down payment hurts itself by missing out on the advantages of owning commercial property. Leasing is likely more expensive than owning, in the long run. If your business is established and you have the cash to purchase, you should seriously consider doing so.

Loss of Appreciation

When you lease a location, you do not benefit from the property appreciating in value over time. You end up losing money on this end because as the value of the building you are occupying increases your leasing rates will increase as well.

Contractual Penalties

When you enter into a lease agreement, you want to be 100% sure that you fully understand your rights and how you are to treat the property. Breaching a lease agreement can be very costly, and you want to avoid doing so.

Loss of Salvage Value

Many businesses will have to install equipment or make changes to the property so that they can perform their work as needed. These changes have been agreed upon, but once the lease is over the business owner usually must remove all changes made at their own expense.

Control

As a tenant, you have little control over property operations. You cannot choose the people or businesses that move into other parts of the building or the people that are put in place to run the building.

Conclusion

Whether to own or lease property is a decision that a business owner should make, utilizing the guidance of a trusted commercial real estate broker, and evaluating numerous factors.

Now that you are aware of the substantial differences and intricacies between owning and leasing, you should consider talking to an experienced professional commercial real estate broker. A professional and knowledgeable broker will help get you started on your journey to the perfect property for your business, whether leased or owned.

R.O.I Properties has decades of experience in the commercial real estate industry in The Greater Phoenix Area. Our brokers can help you figure out what the individual pros and cons of owning vs. leasing would be for your specific business.

Contact us today. We would welcome the opportunity to assist you in making the best commercial real estate decision for you/your business.